Complete Guide to China Tax Refund

Essential Shopping Guide for International Visitors

🎯 Who is Eligible for Tax Refunds?

If you are a foreign national or visitor from Hong Kong, Macau, or Taiwan who has resided in mainland China for no more than 183 consecutive days, you can apply for departure tax refunds.

💰 How Much Can You Save?

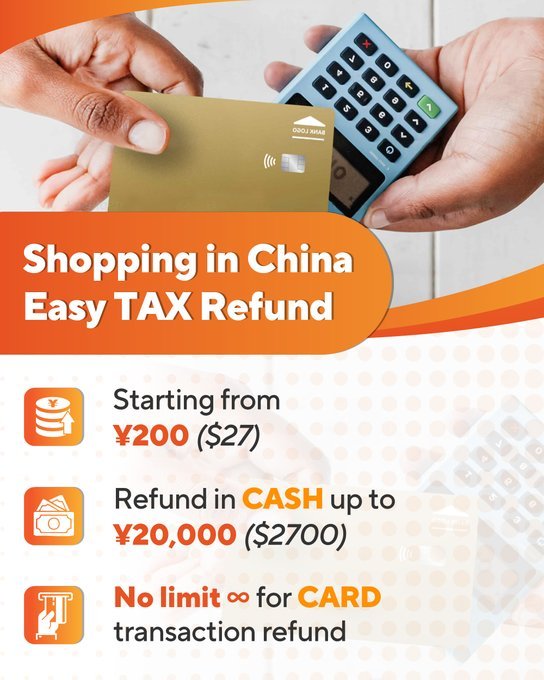

- Minimum Purchase: RMB 200 per store per day to qualify for refunds

- Refund Rate: Up to 11% tax refund (equivalent to 10% discount on purchases)

- 13% VAT items → 11% refund

- 9% VAT items → 8% refund

🛍️ What Items Are Eligible?

Refundable Items: Clothing, cosmetics, jewelry, bags, electronics, gifts, tea, porcelain, traditional Chinese medicine, time-honored Chinese brands, and other consumer goods

Non-Refundable Items: Items prohibited from export, goods already enjoying duty-free policies

📋 Tax Refund Process (3 Simple Steps)

Step 1: Obtain Tax Refund Form When Shopping

- Shop at stores displaying “Tax Refund” signs

- Present your passport or travel permit when checking out

- Request the “Departure Tax Refund Application Form” (stamped invoice)

- Ensure the application form matches your shopping receipts

Step 2: Customs Verification at Departure

- Before departure, bring your passport, shopping receipts, and tax refund application form

- Go to the customs tax refund counter at the departure port

- Customs will verify your goods and stamp the application form for confirmation

Step 3: Collect Your Refund

Traditional Method: Present stamped application form at airport/port tax refund counters

New Method: For stores supporting “Refund-on-Purchase,” you can collect refunds immediately at designated locations

🚀 “Refund-on-Purchase” Service Explained

What is “Refund-on-Purchase”?

Shop and get your tax refund immediately at designated mall locations—no need to wait until the airport! Save time and hassle.

Requirements

- Shop at stores supporting “Refund-on-Purchase”

- Minimum purchase of RMB 200

- Valid ID and credit card (for pre-authorization)

🏙️ Major Cities Tax Refund Guide

🏛️ Beijing

Centralized Refund Points: Wangfu Central Mall Tax Refund Counter

Major Shopping Districts & Malls:

- Wangfujing: Wangfu Central, Oriental Plaza, APM, Beijing Department Store

- Sanlitun: Sanlitun Village

- Others: SKP, China World Mall

Notable Stores:

- International Brands: Luxury brand boutiques

- Time-Honored Chinese Brands: Tongrentang, Lao Fengxiang, Ruifuxiang

- Specialty Items: Tea shops, porcelain stores, traditional medicine shops

Payment Methods: Credit card pre-authorization, cash and bank transfer supported

🏢 Shanghai

Centralized Refund Points: HKRI Taikoo Hui, Shanghai Village

Major Shopping Districts & Malls:

- Nanjing Road: No.1 Department Store, The Place

- Huaihai Road: K11, iapm Mall

- Xujiahui: Plaza 66, Pacific Department Store

- Pudong: IFC Mall, Super Brand Mall

Special Services: Shopping village model—collect refunds on-site and continue shopping

Payment Methods: Cash, bank cards, mobile payments

🌸 Guangzhou

Centralized Refund Points: Tee Mall (first “Refund-on-Purchase” location)

Major Shopping Districts & Malls:

- Tianhe District: Tee Mall, Taikoo Hui, Grandview Mall

- Yuexiu District: Beijing Road Shopping Area

- Haizhu District: Pazhou area malls

Service Features:

- City-wide refund service (500+ tax refund stores)

- Coverage across 11 districts

- Cash available within minutes

🐼 Chengdu

Centralized Refund Points: Chengdu IFS Mall, SKP (planned)

Major Shopping Districts & Malls:

- Chunxi Road: Chengdu IFS, Taikoo Li

- Others: SKP, MixC Mall

Service Scale: 429 tax refund stores, 49 offering “Refund-on-Purchase”

🌊 Shenzhen

Leading Digital Tax Refund City

Major Shopping Districts & Malls:

- Futian District: KK Mall, COCO Park

- Nanshan District: Sea World, MixC Mall

- Luohu District: MixC Mall, KK Mall

Special Services:

- Alipay “Tap-to-Refund”: Open Alipay, tap the refund terminal, scan QR code for instant refund

- Tax refund mini-program: Digital processing

- 1,000+ tax refund stores (most in China)

- Multiple land border refund counters

Refund Locations: Futian Port, Bay Area Port, airports, etc.

💳 Tax Refund Payment Methods

Cash Refund

- Maximum RMB 20,000 per transaction

- Amounts over RMB 20,000 must be processed via bank transfer

Bank Card Refund

- Supports major bank cards

- Faster processing time

Electronic Payment

- Alipay refund (Shenzhen and other cities)

- WeChat Pay (select areas)

equired Documents

- Passport or travel permit for Hong Kong, Macau, Taiwan visitors

- Shopping receipts

- Tax refund application form

- Departure proof (boarding pass or ticket)

Product Requirements

- Items must be personally carried

- Customs may require on-site product verification

📍 Quick Processing Tips

Recommended Routes

- Plenty of Time: Choose “Refund-on-Purchase” service for immediate refunds after shopping

- Tight Schedule: Traditional airport refunds, but allow sufficient time

Best Practices

- Confirm tax refund availability before shopping (look for “Tax Refund” signs)

- Keep all shopping receipts

- Research refund locations in your city beforehand

- Plan departure time accordingly